Contents

Novice or introductory traders can use micro lots, a contract for 1,000 units of a base currency, to minimize or finetune their position size. Trend trading strategies involve entering in the direction of the trend and attempting to capture a profit if the trend continues. Frequency shakepay review of trades – Scalping forex takes advantage of the fact that smaller price moves tend to occur more frequently than big ones. Once it has broken below the 50-EMA by 10 pips or more, and once the MACD crosses to negative within the last five bars, then a short position can be opened.

Because of this low target, quantity is key and you may find yourself placing over 100 trades per day. Scalping is a popular strategy among investors who enjoy fast, exciting trading environments and have laser focus when it comes to charting analysis. As such, the merits and limitations between forex scalping vs day trading or swing trading are notably different and we will explore these later. ForexSignals.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Room.

Key Things A Forex Scalping Strategy Needs

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. If you’re trading with an account size of $10,000, that’s a little instaforex review more than 2% of your account. Most traders are willing to risk that much or more on a single trade. So for the cost of a stop loss, you can invest in your trading success and discipline.

It is also similar to but differs from conventional pumping and dumping, which usually does not involve a relationship of trust and confidence between the fraudster and their victims. Whenever the spread is made one party must pay it and some party will receive that money as profit. The role of a scalper is actually the role of market makers or specialists who are to maintain the liquidity and order flow of a product of a market. Trading CFDs on leverage involves significant risk of loss to your capital.

‘Execution’ refers to when the trades that you place are actually fulfilled by your broker. This means your direct expense would be about USD 20 by the time you opened a position. Sophisticated software that scans through all the charts, on all time frames and analyzes every potential breakout, with high accuracy. During the day, the Stochastic generated 4 divergences, all of the scalping signals being successful.

After this, you need to look for either an overbought or underbought condition in the trend. Then, use the stochastic as a guide to enter or exit on pullbacks. One last thing to remember about trading volume is to never trade one movement!

Is scalping a viable strategy?

The US Dollar / Japanese Yen pair correlates positively with USD/CAD and USD/CHF pairs. Trading strategies help to navigate the world’s financial markets in a structured and systemised way. A trading strategy helps the individual trader to make high-quality trading decisions.But what is a good trading strategy? In this ‘Trading Strategies’ guide, we cover the six different types of tra…

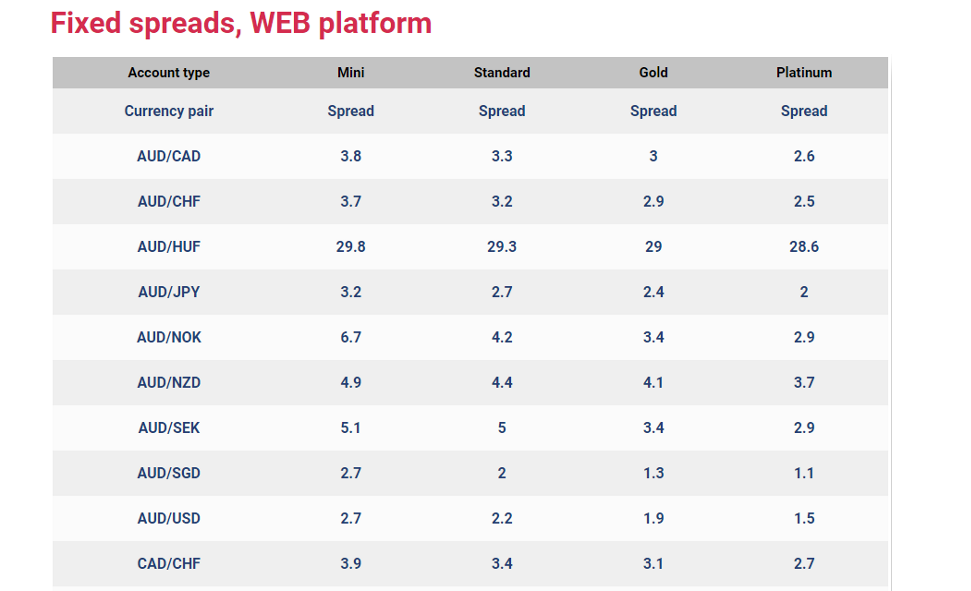

Range strategies identify support and resistance areas and then the trader attempts to buy near support and sell near resistance. Forex scalpers require a trading bitbuy review account with small spreads, low commissions, and the ability to post orders at any price. All these features are typically only offered in ECN forex accounts.

Forex scalpers keep risk small in an attempt to capture small price movements for a profit. The small price movements can become significant amounts of money with leverage and large position sizes. Forex scalpers will typically hold trades for as little as seconds to minutes at a time, and open and close multiple positions within a single day. Yes, it can be challenging and risky because the small profit-per-trade means it is harder to reach a financial target.

Previous PostWhy The Stock Market And Headlines Don’t Match

Each product within the market receives different spread, due to popularity differentials. The more liquid the markets and the products are, the tighter the spreads are. Some scalpers like to trade in a more liquid market since they can move in and out of large positions easily without adverse market impact.

- They don’t have to manually scan all the pairs and look for the correct signals to enter the markets.

- Both cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money.

- It follows from the foregoing that FX Scalping AutoBot’s liability cannot be held directly or indirectly, particularly in the event of a financial loss, regardless of its amount.

However, whilst it is possible to make profits every day, your gains can also be wiped out just as easily. This is because it can be difficult to close your positions quickly enough if the market suddenly moves against you. Do not take the trade if the price is simply trading between the 50 and 100 EMA. A day trader, for example, might look to open 5-10 positions over a single session. A scalper might do that in a single hour, on a single market – keeping each trade open for minutes or even seconds at a time, to capture a handful of pips of profit.

They will be more prone to take trades they normally wouldn’t and to be less rigorous in their risk control. For example, if you go long EUR/USD, with a bid-ask spread of 2 pips, your position instantly starts with an unrealized loss of 2 pips. A trader is literally trying to “scalp” lots of small profits from a huge number of trades throughout the day. Depending on volatility, the trader typically risks four pips and takes profit at eight pips. The reward is twice the risk, which is a favorable risk/reward.

Forex Scalping

Past performance of any results does not guarantee future performance. Therefore, no representation is being implied that any account can or will achieve the results indicated in this website. Naturally, the indicator will show the signal with an up arrow. The question is where to place a safety order and where to take profits.

Transactions concluded on these signals give high performance. Following these tips, working on a trend, you can make good money with scalping. It is best to use the system on the euro/dollar, where the least noise.

When you are relying on the tiny profits of Forex scalping, this can make a big difference. Let’s analyze a SELL ONLY DAY. The exponential moving averages remained in short mode after the Tokyo session, so we were safe to search for short entries. Scalper traders open multiple trades a day, depending on their trading systems. This might not beneficial for your mental health in the long term, to trade so often, at such a high intensity. While position traders will have to make a lot of market research and preparation before entering a trade, a scalper trader just uses several tools before entering the market.

These and other acute questions have been answered by the traderXlab experts. As a bonus, you will also learn a popular 1 minute scalping strategy, a powerful 1 min scalping system, used by many professional traders. Disciplined FX LLC provides general information, educational courses, and material only. Disciplined FX LLC is not offering to Buy/Sell futures, stocks, commodities cryptocurrencies, or forex. Futures, stocks, spot currency, cryptocurrencies, commodities, and bonds come with significant potential risk.

Scalpers generally choose to trade on highly liquid markets, because this allows them to get in and out of positions quickly. It can also help reduce the cost of speculating on small price movements, as more liquid markets often have lower spreads. Conversely, the methods that rely on indicators use scalping generated by the software to spot entry and exit points. Unlike a day trader, scalpers open a position then close it again within the current trading session.